Backed & Supported by

Three reasonsteams engage us in China

Can we de-risk this strategic move?

Most teams underestimate policy execution complexity.

- •Map industrial parks and capability clusters

- •Reality-check incentives and feasibility

- •Structured diligence for expansion or JV targets

Is this supplier ready for our scale?

Most teams underestimate subcontractor opacity.

- •Identify, qualify, and rank manufacturing partners

- •Validate capability depth and compliance readiness

- •Reduce execution and delivery risk

How do we navigate this complexity?

Most teams underestimate stakeholder evidence needs.

- •Build defensible business cases with evidence

- •Navigate compliance and operational requirements

- •Execute with bounded scope and clear deliverables

Most projects are a blend. Our process adapts - the scope stays bounded.

Why Vietnam

is compelling

Why Trust OurVietnam Intelligence?

Our approach combines deep local networks, systematic methodology, and institutional-grade research infrastructure

20-Year In-Country Network

Our Vietnam specialists have spent decades building relationships with factory owners, industrial park operators, and government officials across all major economic zones.

Bloomberg-Grade Methodology

Our 6-stage validation process ensures every insight is cross-referenced, verified, and updated continuously - not based on outdated annual reports.

10+ Years in VC & Tech

Founded by experienced professionals with 10+ years in venture capital, tech investment & innovation across Partech Ventures, ID Capital, Google and more.

Whether you're running a €1,400 triage or a €80k verification project, this process stays consistent. No scope creep, no methodology shifts mid-engagement.

Economic Zones Matter

Understanding which zone your supplier operates in is critical. Infrastructure, incentives, and capabilities vary dramatically by region.

Hanoi

National political center. High-value software & biotechnology hub hosting major MNC headquarters.

Research & Institutional Network

Intelligence sourced from established institutions

FTU

Foreign Trade University (FTU)

Trường Đại học Ngoại thương

HUST

Bach Khoa HanoiHanoi University of Science and Technology

Đại học Bách khoa Hà Nội

VNU

HanoiViet Nam National University, Hanoi

Đại học Quốc gia Hà Nội

MOFA

Ministry of Foreign Affairs of Viet Nam

Bộ Ngoại giao

BUV

British University Vietnam

British University Vietnam

HEPZA

HCMC Industrial & Export Processing Zones

Ban quản lý các khu chế xuất và công nghiệp Thành phố Hồ Chí Minh

BBW

VietnamBloomberg Businessweek Vietnam

Bloomberg Businessweek Vietnam

Our Vietnam intelligence combines academic research, government data, industry networks, and on-the-ground verification across 63 provinces.

These failures compound. They rarely appear alone.

The cost of a wrong decision is not price. It is time, reputational risk, and internal credibility loss.

The Definitive vietnam Manufacturing Intelligence

Tocco Report: Vietnam Industrial Stack 2030 Edition

Vietnam has outgrown its label as a low-cost assembly line. With exports topping US$405.5 billion in 2024, trade flows now more than double the size of its GDP. Global manufacturers from Samsung to Nike, Intel to Pouyuen, anchor supply chains here, while foreign capital stock has surged past US$322 billion, driving more than 70% of the country’s exports. Vietnam is no longer on the margins of globalization, it is embedded in its core. What makes this moment decisive is the shift from assembly to capability. From robotics and smart factories to biotech and advanced materials, Vietnam is stretching into higher-value terrain, even as weak supplier depth, rising wages, and energy constraints remain. The stakes are clear: execution will determine whether Vietnam cements its role as an industrial powerhouse or stalls at mid-value production. This report by the Tocco team maps that stack, offering a clear-eyed view of Vietnam’s industrial ascent and its limits.

Critical Intelligence Insights

- Executive Signals - Vietnam’s industrial ascent in numbers, trade, and FDI flows.

- Electronics & Semiconductors - From assembly hub to chip design ambitions.

- Green Manufacturing - Textiles, plastics, and the circular push.

- Robotics & Smart Factories - Automation shifts Vietnam up the value chain.

- Artificial Intelligence - Predictive, data-driven, and factory-ready.

- Logistics & Corridors - Ports, highways, and Vietnam’s global gateways.

- Biotech & Health Manufacturing - Vaccines, generics, and medtech expansion.

- Materials & Specialty Chemicals - Rare earths, polymers, and the battery race.

- Outlook & Playbook - Scenarios, risks, and strategies for investors and buyers.

Insider Access Required

Register to unlock pricing & full details

Vietnam IntelligenceDownloadable Toccographics

Decision-grade infographics covering FDI momentum, trade access, industrial corridors, demographics, and risk surfaces.

Sign up to download • No credit card required

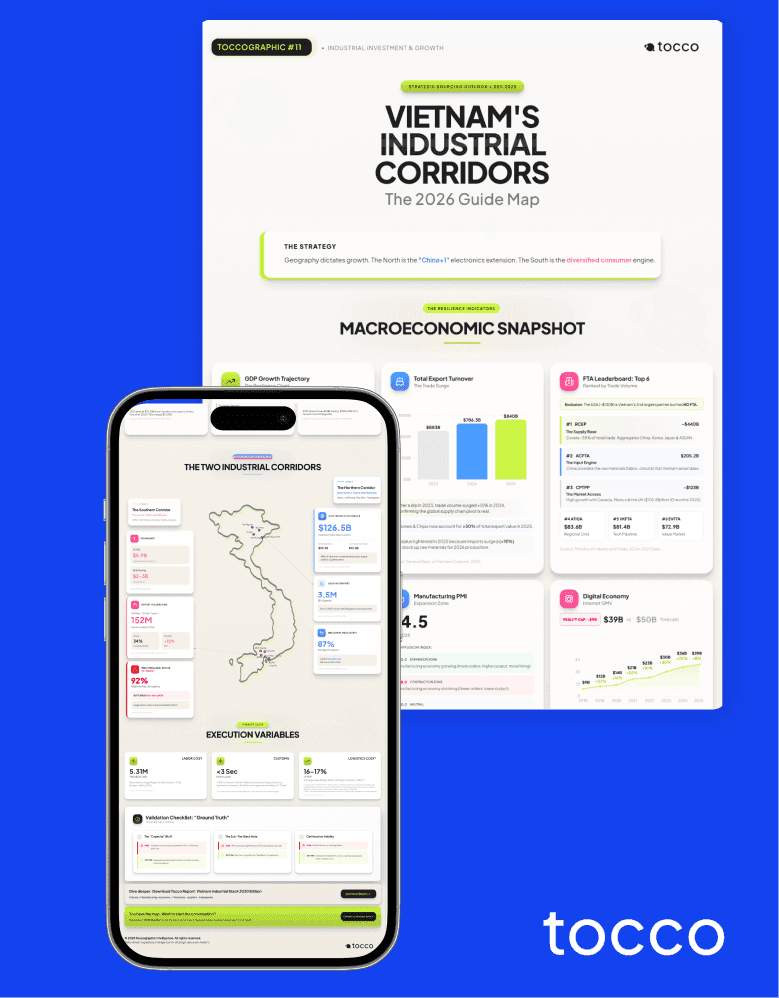

Toccographic #11: Vietnam's Industrial Corridors - the 2026 Guide Map

A 2026 Map Of Vietnam’s Two Manufacturing Corridors And The Sourcing Signals That Matter

An infographic mapping Vietnam’s industrial corridors for 2026: macro signals, North vs South strengths, export and port nodes, lead-time levers, and a supplier validation checklist for sourcing teams.

Sign in to download

More intelligence coming

Sign up to get notified when new Vietnam Toccographics are released

All Toccographics are free with registration • Premium analysis available via Vietnam Triage

EngagementLadder

Evidence-first Vietnam industrial decisions - from screen to verified execution. One engine, three missions: Source • Build • Invest.

Best fit: €5M+ organizations with strategic mandate • Not a fit: Commodity sourcing

Join toView Pricing

Tocco serves operators making critical manufacturing and investment decisions in Vietnam. Create your free account to access transparent advisory pricing, fixed-scope guarantees, and detailed engagement frameworks-no sales pressure, zero hidden fees.

Same discipline, same evidence. Different decision types.

Trusted by procurement, sourcing, and strategy teams at companies that take vietnam seriously.

Stop guessing.

Start with vietnam Triage.

Every inquiry reviewed personally. We only take projects where we can deliver measurable value.

Common questions

Straight answers to the questions teams actually ask

More questions? Start with vietnam Triage - we'll answer everything specific to your case.