Backed & Supported by

Three reasonsteams engage us in China

Can we de-risk this strategic move?

Most teams underestimate policy execution complexity.

- •Map industrial parks and capability clusters

- •Reality-check incentives and feasibility

- •Structured diligence for expansion or JV targets

Is this supplier ready for our scale?

Most teams underestimate subcontractor opacity.

- •Identify, qualify, and rank manufacturing partners

- •Validate capability depth and compliance readiness

- •Reduce execution and delivery risk

How do we navigate this complexity?

Most teams underestimate stakeholder evidence needs.

- •Build defensible business cases with evidence

- •Navigate compliance and operational requirements

- •Execute with bounded scope and clear deliverables

Most projects are a blend. Our process adapts - the scope stays bounded.

Why China remains exceptionalfor serious operators

Our Supply ChainIntelligence Infrastructure

Navigating China's industrial complexity requires more than Google searches - it demands systematic intelligence and ground truth

150+ Countries Mapped

Our AI-powered data engine continuously monitors global supply chains, tracking 10,000+ material suppliers and manufacturing partners across Asia-Pacific, Europe, and beyond.

Former Fortune 500 Expertise

Our expert network includes former procurement executives from Google, L'Oréal, and multinational manufacturers who've negotiated billion-dollar supply contracts.

AI + Human Validation

Machine learning models surface patterns and anomalies, but every critical insight is verified by our 40+ material scientists, industrial engineers, and regional specialists.

Whether you're running a €1,400 triage or a €80k verification project, this process stays consistent. No scope creep, no methodology shifts mid-engagement.

China IndustrialClusters Atlas

Real-time intelligence across China's key manufacturing and innovation zones. Track clusters, capabilities, and economic dynamics.

Shenzhen

ELECTRONICSPearl River Delta

China's Silicon Valley. Home to Huawei, DJI, Tencent. World's largest electronics cluster.

gdp growth

6.9%

fdi

$15B+

ind. parks

45+

Key Sectors

Real-time Status

All Clusters

Research & Institutional Network

Intelligence sourced from established institutions

Tsinghua

Tsinghua University

清华大学

CASS

Institute of Industrial EconomicsChinese Academy of Social Sciences

中国社会科学院

MOFCOM

Ministry of Commerce

中华人民共和国商务部

PKU

Guanghua SchoolPeking University

北京大学

SDRC

State Development & Research Center

国务院发展研究中心

SJTU

Antai CollegeShanghai Jiao Tong University

上海交通大学

FT China

Intelligence UnitFinancial Times China

金融时报中国

Our Vietnam intelligence complements China research, government data, industry networks, and on-the-ground verification across manufacturing hubs.

The Definitive china Manufacturing Intelligence

Tocco Report: China’s New Industrial Stack Yearbook 2026

China now produces a third of global manufacturing output. This report explores its shift to high-tech industries and global leadership.

Critical Intelligence Insights

- Policy Landscape - From “Made in China 2025” to the 14th Five-Year Plan

- New Energy Vehicles (EVs)- Driving the Electric Revolution

- Clean Energy and Renewables - Powering a Green Transition

- Semiconductors - The Quest for Technological Self-Sufficiency

- Biotechnology and the Bioeconomy - China’s Next Frontier

- Artificial Intelligence & Digital Economy - A Tech Powerhouse Rising

- Robotics & Advanced Manufacturing - Automating the Factory of the World

- Frontier Industries - Aerospace and New Frontiers

Insider Access Required

Register to unlock pricing & full details

China MarketIntelligence Infographics

Visual intelligence on China's manufacturing landscape. Free downloads with registration.

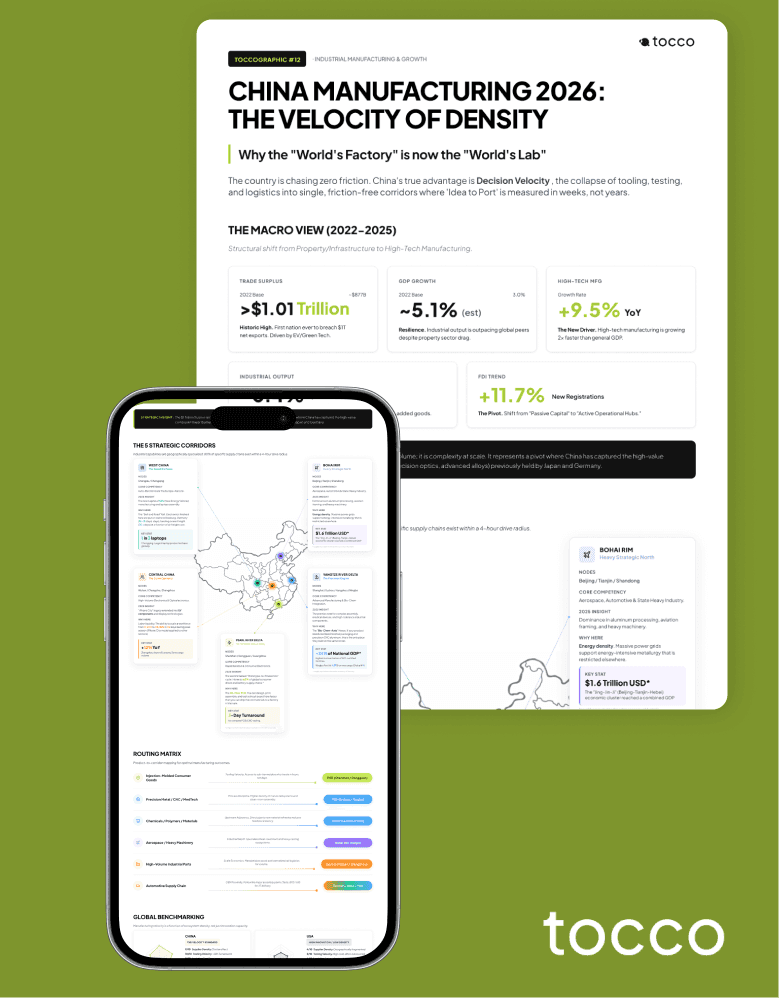

Toccographic #12: China Manufacturing 2026: The Velocity of Density

An infographic explaining China’s manufacturing advantage in 2026: industrial density, strategic corridors, execution speed, routing by product type, and the risks of choosing the wrong manufacturing region.

Toccographic #15: 2026 Regulatory Hard-Stops ⋅ Top 10 Signals to Follow

Briefing on the top 10 regulatory “hard-stops” for 2026: PFAS, deforestation, CBAM, labor rules, DPP and OSOA. with timelines, risk exposure and practical preparation signals

All toccographics are free with registration • Updated monthly

EngagementLadder

Start with Rapid Screen (€950) or full Triage (€2,500). Scale strategically. Each step builds on the last - no pressure, just proven progression.

Best fit: €5M+ organizations with strategic mandate • Not a fit: Commodity sourcing

Join toView Pricing

Tocco serves operators making critical manufacturing and investment decisions in Vietnam. Create your free account to access transparent advisory pricing, fixed-scope guarantees, and detailed engagement frameworks-no sales pressure, zero hidden fees.

Same discipline, same evidence. Different decision types.

China OperatorExpedition

A private, executive-grade industrial expedition for teams making ≥$5M China decisions who need ground truth, not guided tours.

Not networking. Not tourism. Tailored intelligence gathering.

What's included (bounded, premium)

- Pre-brief and objective definition

- Curated meetings (capped)

- Factory visits with checklists

- Live interpretation and context decoding

- Post-expedition decision memo

- Next-step action plan

Not included:

- • International flights

- • Visas and related government fees

- • Hotels and meals (unless explicitly bundled)

- • Local transport (unless explicitly bundled)

Routes into paid triage • Pricing disclosed after qualification

Trusted by procurement, sourcing, and strategy teams at companies that take china seriously.

Stop guessing.

Start with china Triage.

Every inquiry reviewed personally. We only take projects where we can deliver measurable value.

Common questions

Straight answers to the questions teams actually ask

More questions? Start with china Triage - we'll answer everything specific to your case.